The world of Forex trading has undergone a dramatic transformation with the advent of mobile technology. No longer confined to the desktop, traders can now engage in the dynamic world of currency trading from their smartphones. This evolution not only enhances the trading experience but also democratizes access to financial markets. At the forefront of this change are innovative mobile applications that offer robust trading solutions. For those interested in exploring these options, sites like forex trading mobile app trading-ph.com provide valuable insights.

The Rise of Forex Trading Mobile Apps

As technology continues to advance, the demand for flexibility in trading has grown exponentially. Mobile apps have risen to meet this need, allowing traders to access the Forex market on-the-go. Today, a trader can execute trades, track market movements, and analyze trends all from the palm of their hand. This shift not only provides convenience but also empowers traders to react swiftly to market changes.

Key Features of Forex Trading Mobile Apps

Mobile trading apps are equipped with a wide array of features designed to enhance the user experience. Some of the essential features include:

- User-friendly Interface: Modern trading apps are designed with an intuitive interface, making it easy for traders of all levels to navigate.

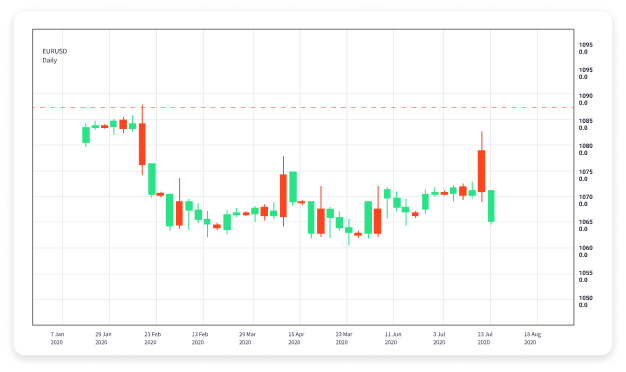

- Real-time Market Data: Access to live quotes, charts, and news is crucial for making informed trading decisions.

- Advanced Charting Tools: Many apps come with built-in technical analysis tools that allow traders to analyze price movements effectively.

- Secure Transactions: Security features, including two-factor authentication, ensure that user data and funds remain protected.

- Multiple Account Management: Users can manage multiple trading accounts from one app, simplifying their trading activities.

The Advantages of Trading on Mobile Apps

The benefits of using mobile apps for Forex trading extend beyond convenience. Here are some of the advantages that attract traders to use these platforms:

1. Flexibility and Convenience

With mobile apps, traders no longer need to be tied to their desks. They can monitor the markets, respond to trades, and manage their portfolios from anywhere. This flexibility allows them to take advantage of trading opportunities 24/7.

2. Instant Notifications

Mobile trading apps often include push notifications that alert traders to market movements or important news updates. This instant access means that they can act immediately, helping to capitalize on market volatility.

3. Enhanced Accessibility

The proliferation of smartphones has made Forex trading accessible to a wider audience. Aspiring traders can start with minimal investment, using mobile apps to learn and practice trading strategies without the burden of hefty fees.

4. Educational Resources

Many Forex trading apps come with educational resources such as tutorials, webinars, and articles that help traders enhance their knowledge and skills in real-time.

Challenges to Consider

While the benefits of trading through mobile apps are significant, there are also challenges to keep in mind:

1. Screen Size Limitations

While mobile devices provide convenience, the smaller screen size can make detailed analysis challenging compared to larger displays on desktops. Quick decision-making may come at the expense of thorough analysis.

2. Connectivity Issues

Mobile trading is reliant on a stable internet connection. In areas with poor connectivity, traders could miss out on crucial opportunities or face delays in executing trades.

3. Security Concerns

Despite advancements in security measures, mobile trading apps are still vulnerable to cyber threats. Traders should ensure they use secure networks and employ best practices when accessing their trading accounts.

Choosing the Right Forex Trading Mobile App

With numerous Forex trading apps available, selecting the right one can be daunting. Here are some factors to consider:

- Regulation: Ensure that the app is regulated by a reputable authority, which helps safeguard your investments.

- Fees: Review the fee structure, including spreads and commissions, to determine the overall cost of trading.

- Customer Support: A responsive customer service team can provide assistance if issues arise, which is crucial for new traders.

- Reviews and Ratings: Look for user reviews to gauge the reliability and performance of the app.

The Future of Forex Trading Apps

As technology continues to evolve, the future of Forex trading mobile apps looks promising. Artificial intelligence (AI) and machine learning are becoming integral to trading platforms, with many apps now offering personalized trading insights based on user behavior and market trends. Moreover, the integration of blockchain technology could enhance the security and transparency of mobile trading.

In conclusion, mobile apps have transformed the Forex trading landscape, providing traders with increased accessibility and flexibility. While challenges exist, the advantages of mobile trading cannot be overlooked. As more innovations emerge, traders can expect an even more sophisticated trading experience, allowing them to navigate the Forex markets with confidence and ease.

Investing in education, understanding market dynamics, and utilizing advanced trading tools through mobile apps will empower traders in their quest for financial success in the ever-evolving Forex landscape.

Comentarios recientes